Present Worth Formula Math

For 4 th year present value 1 000 1 4 4.

Present worth formula math. The present value of a perpetuity can be calculated by taking the limit of the above formula as n approaches infinity. Therefore the present day value of john s lottery winning is 3 629 90. Value dfrac fv 1 r n fv future value. Present value 889 00.

Time value of money is the concept that receiving something today is worth more than receiving the same item at a future date. Make sure to use the same units of time for both the interest rate and the time. The present value pv can be computed using the following formula. N p v today s value of the expected cash flows today s value of invested cash npv text today s value of the expected cash flows text today s value of invested cash n p v.

Present worth value calculator solving for present worth given future value. Present value 3 629 90. Using the present value formula or a tool like ours you can model the value of future money. Present value 961 54 924 56 889 00 854 80.

P f 1 r t p f 1 r t. Present value for all the year is calculated as. Exponents are easier to use particularly with a calculator. To calculate it you need the expected future value fv.

For example 1 10 6 is quicker than 1 10 1 10 1 10 1 10 1 10 1 10. Present value 854 80. If interest rate is 15 enter 15 for i. Pv frac fv left 1 frac r k right k times n for continuous compounding we get that k to infty in which case we need to use the following compounded formula instead.

Formula 2 can also be found by subtracting from 1 the present value of a perpetuity delayed n periods or directly by summing the present value of the payments. Present value worth equations calculator finance investment analysis formulas. R rate of return. Pv 900 1 0 10 3 900 1 10 3 676 18 to nearest cent.

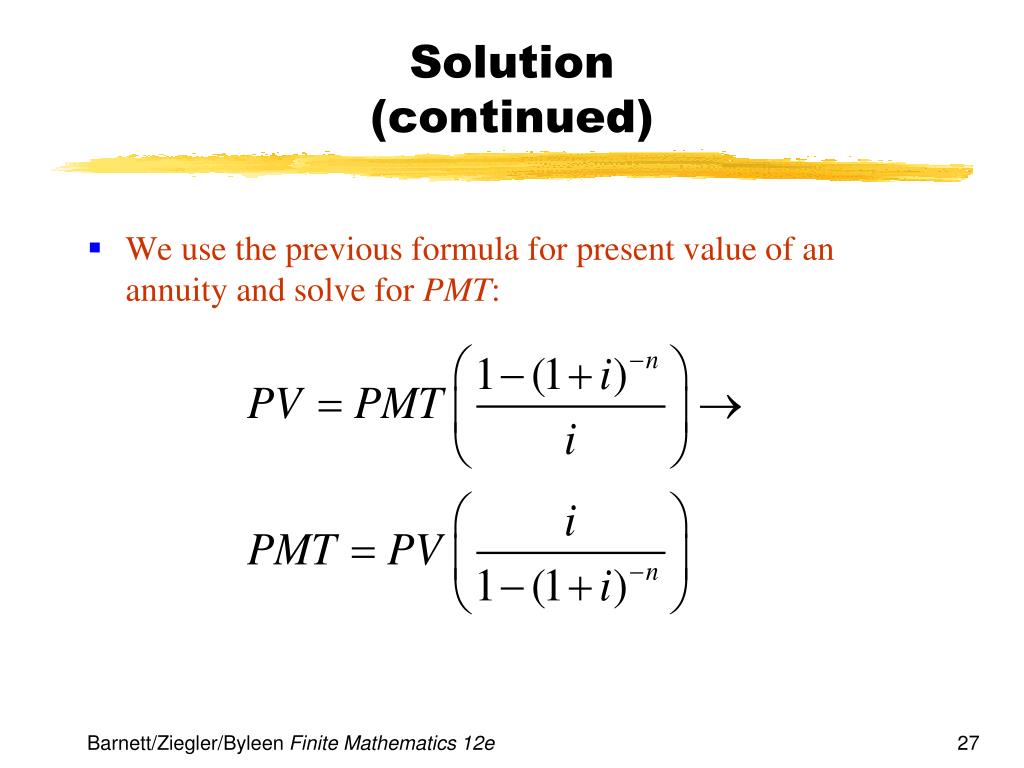

Present value formula present. Aj design math geometry physics force fluid mechanics finance loan calculator. Solving for present value or worth. Pv fv 1 r n.

N number of periods. Present value calculator dqydj. The premise of the equation is that there is time value of money. The present value of money is equal to the future value divided by the interest rate plus 1 raised to the t power where t is the number of months years etc.

Future amount final amount interest rate per year discount rate number of years.

/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-4cf181815e2741debb4174301e1b4b99.jpg)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities6-f3e0ae90db8b4a5398e3fcabd0538a92.png)